Lease deals could be better right now!

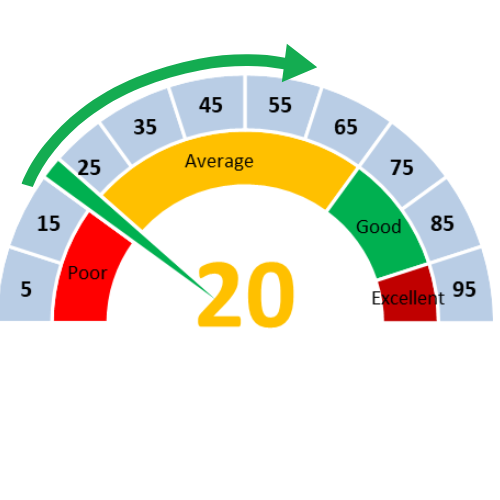

My current car shopping market score is 20. Zero is the worst market to consider buying a vehicle, and 100 is the absolute best. It’s trending in the right direction, and I expect it to improve throughout the year. It is better than 20 because specific scenarios make it a good time to lease or replace your lease. So ensure you find the one that matches your current vehicle situation for the best strategy.

POOR time to purchase 0-20

AVERAGE time to purchase 20-70

GOOD time to purchase 60-90

EXCELLENT time to purchase 90-100

In the past couple of years, I have been asked whether it is an excellent time to get a new car. So I have set out to answer this the best I can based on all the information I have and see every day working in the business.

As we have come out of the pandemic, the past couple of years have been some of the most challenging as a consumer and working in the industry, as I have seen in the 30-plus years I have been in the automobile business.

Factory Incentives and rates make a HUGE impact on the payment.

Why is it the wrong time to lease? On the surface, the payments on a lease are just about as HIGH as I have ever seen, and most that have leased a vehicle in the past ten years or so have been spoiled by VERY low lease payments. So much so that many consumers are shocked to see the costs when there are no, or very few, incentives from the manufacturer to help make the lease attractive.

Over the past year and a half, the manufacturers have had little to no incentives or rebates on anything. Why? It’s relatively simple supply and demand. They could not produce enough vehicles to meet the current market, so why would they offer incentives that cut into their profits, to sell the products they already could not meet demand?

Leasing requires significant incentives to make the payments attractive.

However, it takes a reasonable lease rate and usually some lease rebates/cash combined to make the payments more attractive than a regular loan or financing. All this, combined with interest rates going up so much in a short amount of time the past year, thus the reason we are seeing high or higher payments on the exact vehicle than just a couple of years ago. Also, remember that the average price of new cars has risen significantly more in the past two years than at almost any time in the auto business.

Lastly, we tend only to remember what we want to remember. As much as payments have gone up in the past couple of years, leasing is not worse than ever. Thirty years ago, it was not uncommon to see a $500-600 or much more lease payment on a $40,000 vehicle. So, for example, over the past decade, a $40,000 car might have been leased as low as mid $300-400s because of low rates and high factory incentives. So, yes, we were spoiled with payments that were hundreds of dollars less than even what they used to be years ago.

Is there any reason to lease right now?

If payment is your only deciding factor, not depending on the current lease specials, we are starting to see some incentives roll out as inventories grow.

The other factor that comes to the forefront is that many customers in a lease are coming to an end and want to lease another one. The manufacturers want to retain them with other brands. So we will see them get more aggressive to try and keep current loyal customers in a lease, especially as we move through 2023.

If the payments are outside your budget, it might be a good idea to lease.

Why, you just said it’s a lousy time to lease. As I have said before, it’s not all black and white. If the vehicle you are interested in has a decent lease that fits your budget, there is an extra benefit to leasing that is built in. Leasing takes out most of the long-term risk if you keep it until the end. Put it this way, nobody knows what will happen in this world or with the economy in the next few years, and leasing protects you a little bit. So if you purchase a new car with a loan for, say, 72 months, you are taking a risk that if you need to get out of that car in a few years, it will be worth anywhere near what you owe. So if you had leased one at the end of the three years, you have the option to turn it in and now worry about what its value is or will be, not your problem.

I expect to see lease incentives improve as the year goes on, it might not get to the payments we have seen in the past ten years, but it will be an option to consider again at some point, sooner than later.

Here are ALL of your options if you are currently in a lease!